May 6, 2025

Claudia Melim-McLeod and Daniel Yiu

Updated

In recent thought leadership articles, Daniel and Claudia looked back at how ESG fared in China during 2024, and trends in ESG disclosure in China compared with European standards.

Environmental, social and governance in China: 2024 in retrospect

Towards environmental, social and governance disclosure in China

In this article they examine trends for 2025.

Trend 1: More medium-to-long term capital will be injected into stock market, which may prompt the need for ESG investment to reduce investment volatility

In January 2025, the office of the Central Financial Work Commission revealed a plan to encourage more medium-to-long term capital to be injected into A-share market to boost the capital market. The plan includes the following points:

market capitalization of A-shares held by mutual funds will increase by at least 10% annually for the next three years;

large state-owned insurance companies should seek to allocate 30% of their annual new premiums to invest in A-shares starting from 2025;

an enhancement of innovation in low-to-medium volatility products.

Given that long-term capital investors typically gravitate towards stocks with lower risks and stable financial performance, more asset managers based in China are likely to show interest in integrating ESG risk assessments into their investment portfolios. By doing so, they will aim to minimize tail risk and achieve a more favourable risk-adjusted performance over the long haul.

Trend 2: Rapid reduction in carbon emissions is likely in 2025

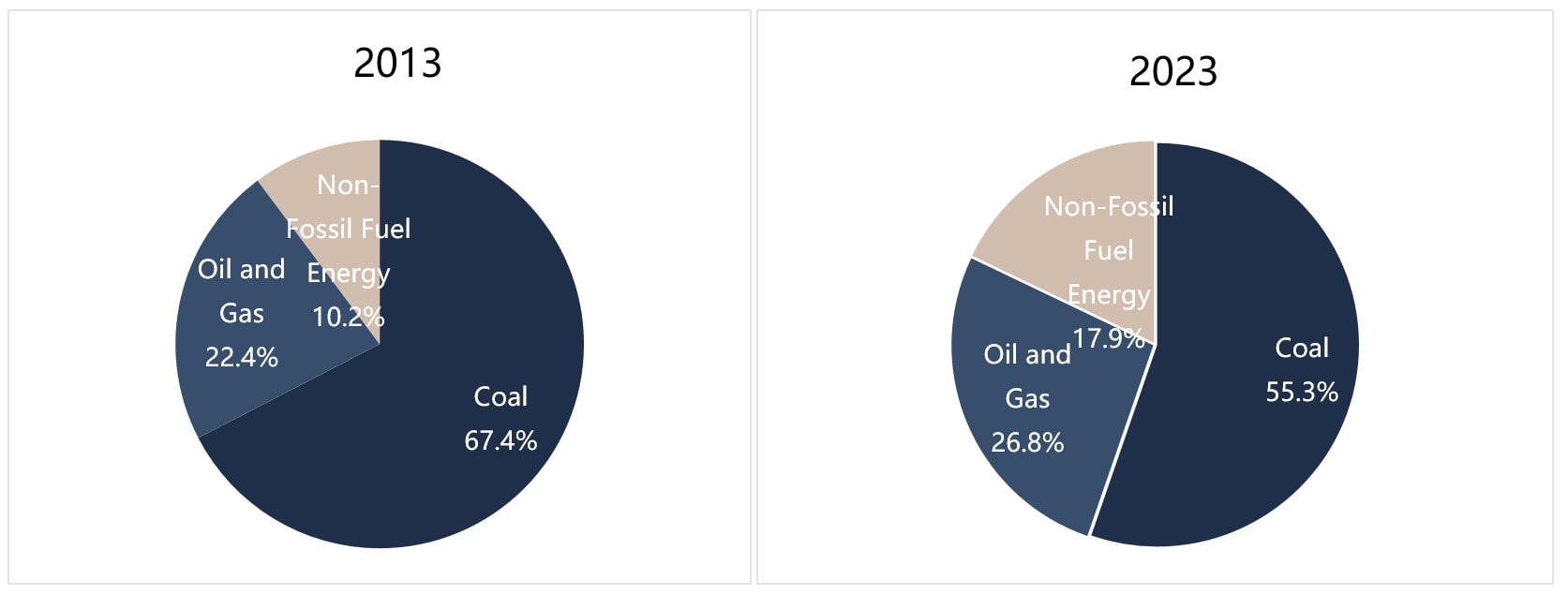

China's 14th Five Year Plan has stated the proportion of non-fossil energy in China’s total energy consumption should reach 20% by the end of 2025, while energy consumption and carbon dioxide emissions per unit of GDP will drop by 13.5% and 18%, respectively, compared with 2020 levels. Based on the statistic released by the Ministry of Ecology and Environment (MEE), the department responsible for ecological and environmental affairs in China, the share of non-fossil fuels in total energy consumption has reached 17.9% in 2023.

Despite China being the world’s leader on renewable energy, capable of installing a remarkable amount of renewable capacity, in 2024, more coal-fired power plants were built to satisfy the ever-growing energy demand, as reported by CarbonBrief. Despite the challenge of maintaining economic growth and reducing carbon emission, the State Council has unwaveringly determined to reduce the energy consumption per unit of GDP by about 3% in 2025, based on 2025 Government Work delivered by the Premier Li Qiang on 5th March, 2025.

Consequently, policymakers have rolled out policies including a trade-in scheme to drive consumers to purchase high energy-efficient/renewable products. According to one estimate produced by the Chinese government, the trade-in scheme has achieved an energy saving of approximately 28 million tons of standard coal equivalent and reduced carbon dioxide emissions by about 73 million tons while driving the sales of consumer goods. From the perspective of accomplishing “dual carbon” goals and safeguarding energy security, we can expect more installation of renewable energy and further initiatives to enhance energy efficiency in 2025.

Figure 1. Between 2013 and 2023, the proportion of non-fossil energy in China’s total energy consumption increased from 10.2% to 17.9%. The proportion of coal fell from 67.4% to 55.3%, while the proportion of oil and gas increased from 22.4% to 26.8% (source: MEE).

Trend 3: Overseas-expanding companies should pay close attention to labour-related matters

An incident involving BYD, the Chinese company that took over Tesla’s leading position in electric vehicle sales in 2024 and is now the world top EV brand, was a stark reminder to Chinese companies venturing overseas of the need to pay close attention to the “S” in ESG. In December 2024, Brazilian authorities shut down a BYD factory after it was revealed that 163 Chinese workers were enduring "conditions comparable to slavery" at a construction site in Bahia, Brazil, owned by BYD. Brazilian authorities reported that the workers were living in unhygienic conditions, working excessive hours with one worker found to have worked for 25 days without a break. Moreover, they were required to pay a deposit, and the company withheld their passports. Shortly after, BYD issued a statement announcing the termination of Jinjiang Construction Brazil, the subcontractor responsible for the controversial construction site.

Top 20 Automotive Brands in the World by Electric Vehicle Sales

Brazil shuts BYD factory site over 'slavery' conditions - BBC News

Many Chinese companies owe their success to a strong work ethic. However, while the Chinese Labour Law sets a limit of 44 average weekly working hours, the National Bureau of Statistics of China shows that in 2024, the actual average weekly working hours in China reached 49 hours. As more Chinese firms look to expand abroad, they will need to not only comply with local labour laws but also put in place rules to safeguard the well-being of their workers.

Recommendations

While we expect ESG to continue to be an important element within China's business and investment scenery, the extent to which it will keep momentum in 2025 is currently an open question.

Globally, the ESG agenda suffered serious setbacks in late 2024 and early 2025, as US and European regulators rolled back measures aimed at curbing adverse business impacts on a wide range of areas, including climate change, pollution, water resources, ecosystems, communities and employee rights, corruption and bribery. While in the United States, the Security and Exchange Commission issued guidance discouraging investors from adopting pro-ESG policies and practices after the US Congress Judiciary Committee called Net Zero Asset Managers (NZAM) Initiative members a “woke ESG cartel”, in Europe the European Commission significantly weakened the EU Taxonomy, the Corporate Sustainability Reporting Directive, Corporate Sustainability Due Diligence Directive and the Carbon Border Adjustment Mechanism through the Omnibus Package.

Judiciary Committee Probes 60+ Companies over ESG Ties

EU taxonomy for sustainable activities

Directive of the European Parliament as regards corporate sustainability reporting

Corporate sustainability due diligence

Regulation of the European Parliament establishing a carbon border adjustment mechanism

Commission simplifies rules on sustainability and EU investments

These developments hardly present an incentive for Chinese regulators to push companies to adopt better ESG standards for global markets that do not expect them. In addition, the question of what ESG truly brings to companies and investment institutions in terms of value is a hot debate topic in China.

From the perspective of Chinese ESG professionals, there is a need to emphasise that ESG is a far-reaching concept that can add value to a company beyond financial aspects. In that sense, it is important to do more than focus on ESG-related regulations and rather adopt a practical approach when assessing what ESG means for a company's shareholders – including the financial benefits a company can gain from actions like reducing carbon emissions or enhancing data privacy protection. Failing to do so, means that ESG will merely remain a marketing gimmick rather than a tool driven by real value. In such a scenario, ESG will be sidelined and will lose its attractiveness to a wider range of stakeholders.

On the other hand, investors and corporates that want to protect themselves from physical, litigation or reputational risks should continue to engage with companies and suppliers, pushing for continuing alignment of their ESG practices with global standards. At the end of the day, industry leaders understand that strong financial returns depend on robust risk management, regardless of the regulatory flavour of the moment.

Building a sustainable future through collaborative research and actionable insights for a better tomorrow.